Shorter receivable collection periods can also be beneficial in avoiding bad debts. Similar to the above ratio, the DSO expresses the result in many days.Ī lower DSO means that a company is recovering its receivables in a short amount of time. The Days Sales Outstanding ratio measures the efficiency of a company in recovering its receivables. Receivables Turnover = Sales / Accounts Receivable 7) Days Sales Outstanding A higher Receivables Turnover ratio means the company collects its credits promptly. This ratio depends on the credit policies of a company. Receivables Turnover is a ratio that measures how many times a company collects its accounts receivable balances. For this ratio, the lower the number of days, the better it is.ĭays Sales in Inventory = 365 (days) / Inventory turnoverĪnother formula to calculate the ratio is as follows.ĭays Sales in Inventory = Inventory / Cost of Goods Sold x 365 days 6) Receivables Turnover Simply put, it shows how much time it takes the company to convert stock into sales. It calculates the time it takes a company to sell off all its inventory.

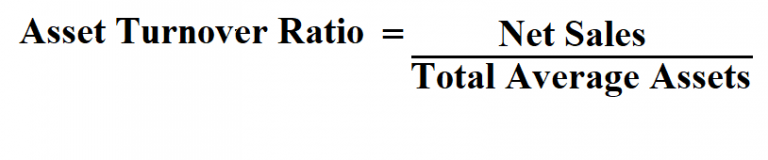

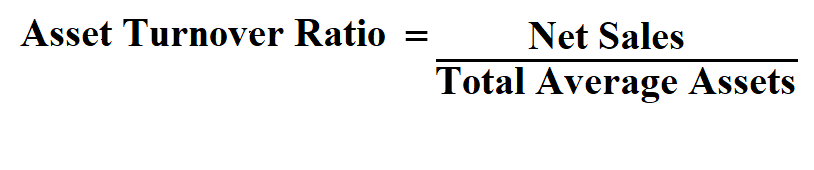

Inventory Turnover Ratio = Net Sales / Inventory 5) Days Sale in InventoryĪnother inventory-related asset management ratio is the Days Sale in Inventory. A low ratio, on the other hand, may indicate slow-moving inventory. While a higher Inventory Turnover Ratio is preferable, it can also indicate a risk of stock outs if it is too high. Related article 4 Limitations of Return on Equity You should Know It shows how many times the company has sold and restocked its inventory within the accounting period under consideration. Net Working Capital Turnover = Sales / Net working capital 4) Inventory Turnover RatioĪnother asset management ratio that is considered critical is the Inventory Turnover Ratio. The higher this ratio is for a company, the better it uses its working capital to generate revenues. However, this ratio is usually a better indicator of a company’s operations than using total assets. It is also a type of asset turnover ratio. The Net Working Capital Turnover is a ratio that signifies the efficiency of a company in using its working capital. While it is a type of asset turnover ratio, some stakeholders prefer only to consider the company’s fixed assets to evaluate its efficiency.Īsset turnover = Sales / Fixed Assets 3) Net Working Capital Turnover This ratio only considers the use of long-term assets as compared to short-term. The Fixed Asset Turnover is a ratio that measures the efficiency of a company in the use of only its fixed assets to produce sales. The higher the company’s asset turnover ratio is, the better and more efficient it is considered by stakeholders.Īsset turnover = Sales / Total Assets 2) Fixed Asset Turnover It gives a summary of all the asset management turnover ratios. The Total Asset Turnover is a ratio that measures the efficiency of a company in the use of all its assets to produce sales. Some of the most commonly used asset management ratios are as below. Therefore, asset management ratios can help with all these aspects and much more. Similarly, just because companies can make profits doesn’t mean they are using their assets effectively. However, judging companies by the amount of their profit is not suitable for comparisons. Usually, stakeholders prefer companies with higher profits. Usually, the better these ratios are, the higher the chances of investors and shareholders investing in the company.įurthermore, these ratios allow stakeholders to analyze the financial performance of a company from multiple aspects. Through these ratios, they can calculate the efficiency and effectiveness of their investments. Usually, asset management ratios are crucial for investors and shareholders. The purpose of why stakeholders calculate asset management ratios depends on the type of stakeholder. Some of the most commonly used asset management ratios include inventory turnover, accounts payable turnover, days sales outstanding, days inventory outstanding, fixed asset turnover, receivable turnover ratios, and cash conversion cycle. Since companies have various types and classes of assets, there are also different ratios for different assets.

As the name suggests, these ratios usually consider only two factors, a company’s assets and revenues. Through these ratios, the company’s stakeholders can determine the efficiency and effectiveness of the company’s assets management.ĭue to this, they are also called turnover or efficiency ratios. Asset management ratios are a group of metrics that show how a company has used or managed its assets in generating revenues.

0 kommentar(er)

0 kommentar(er)